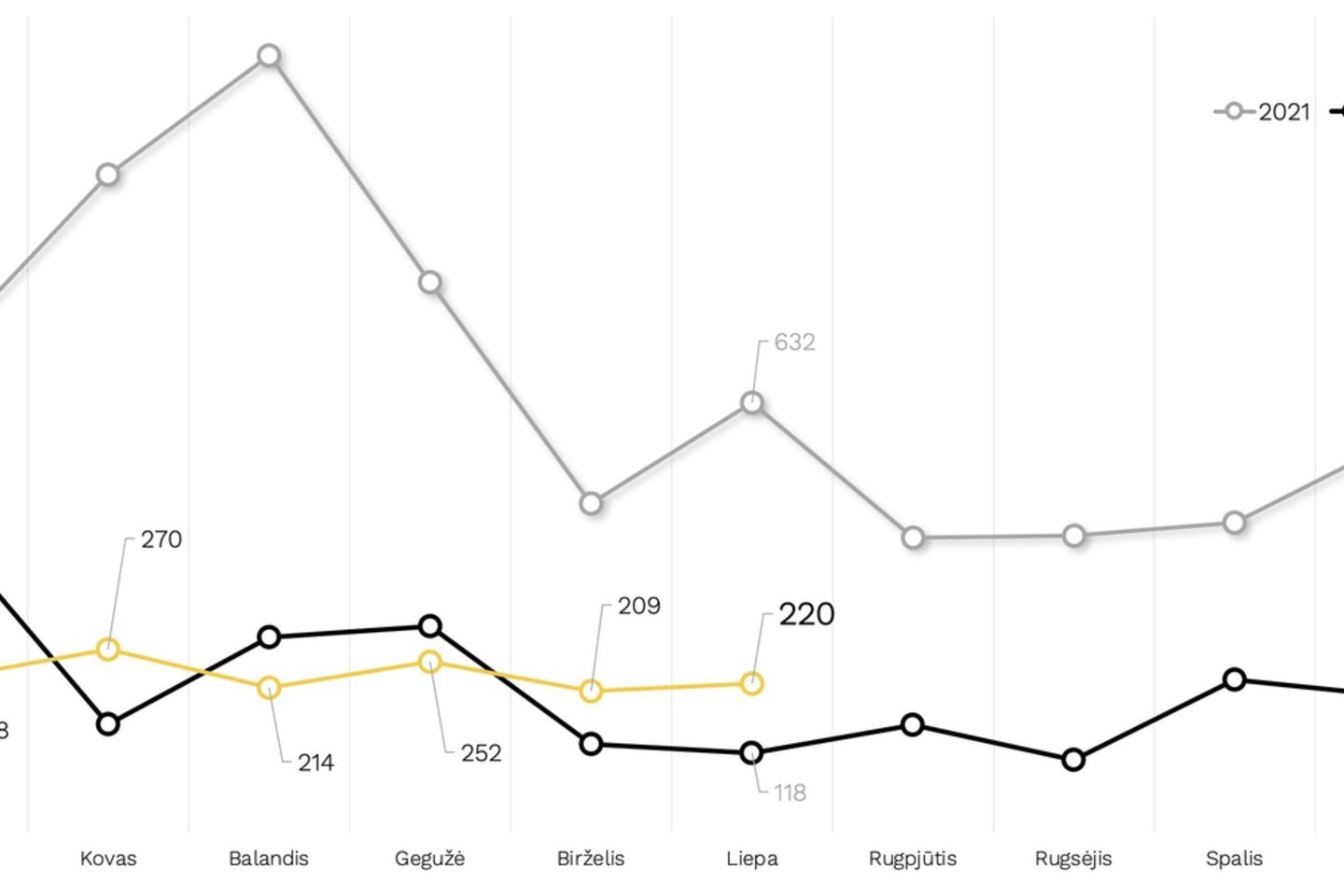

Compared to last July, when Vilnius recorded 118 transactions, the current situation statistically appears better due to the same period last year, even though the reality remains quite similar. Citus analysts calculate that last month's figures included sales from four projects that weren't accounted for in previous months.

„The decrease in housing market activity during the peak of summer isn't surprising. Despite the apparent increase in raw numbers, there have been fewer actual sales. This can be attributed to the intense pressure on Euribor's growth, which prompts buyers to wait for a change in the situation. Some potential buyers are also struggling to secure bank financing for homes. Although the latter situation is partially mitigated by the lowering of fixed margins in response to the Euribor increase. Nevertheless, stable economic indicators, rising wages, and an expanding housing selection provide favourable conditions for homebuyers,“ explains Šarūnas Tarutis, Head of Investment and Analysis at Citus.

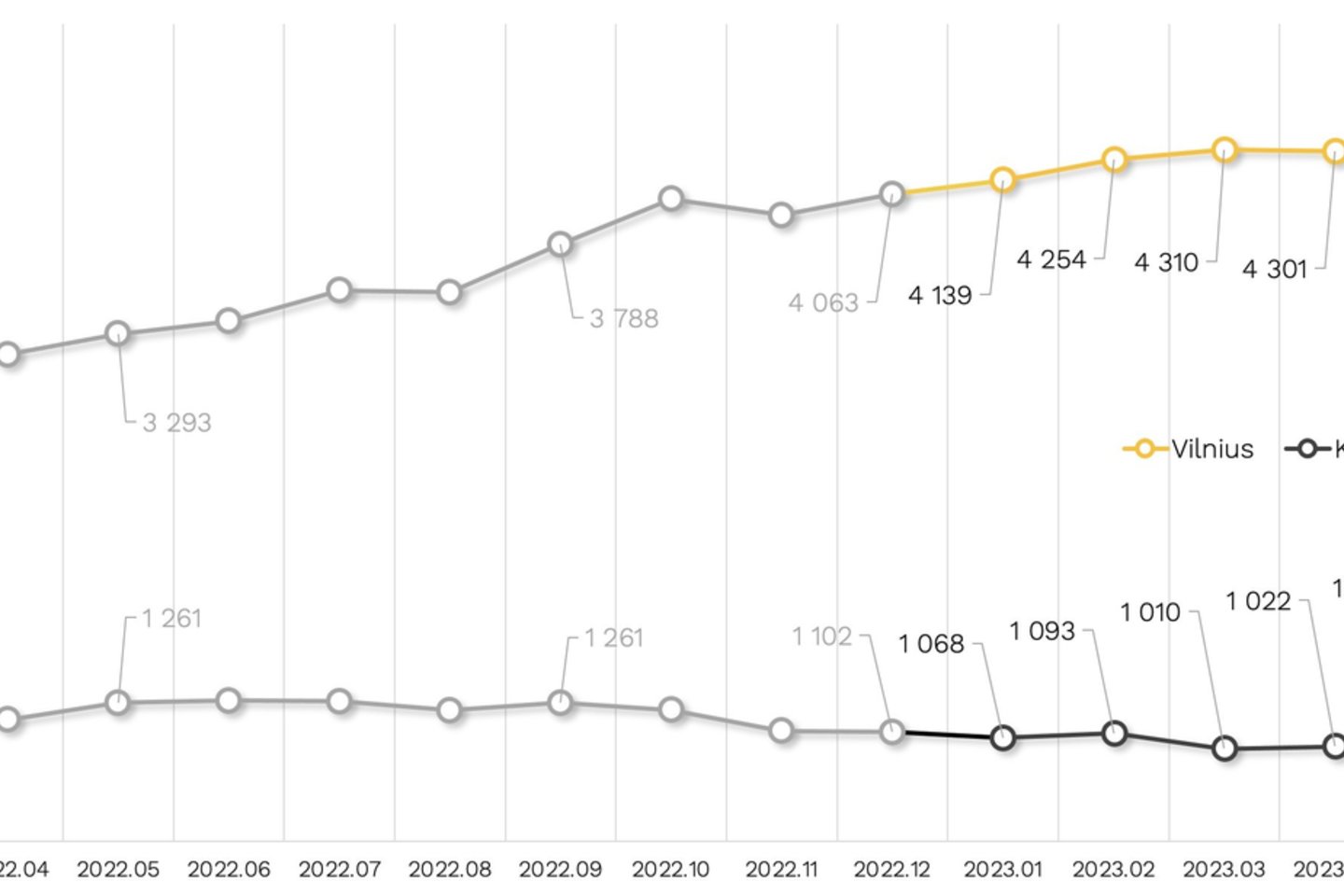

In the previous month, the new housing stock in Vilnius included 4,345 apartments and terraced houses, while Kaunas had 1,080. Supply in the capital has contracted across most segments—medium, prestigious, and luxury. The exception was the economy segment, which experienced an increase in supply due to two new projects and an equal number of previously launched phases. Similar trends were observed in Kaunas, with the introduction of two new projects.

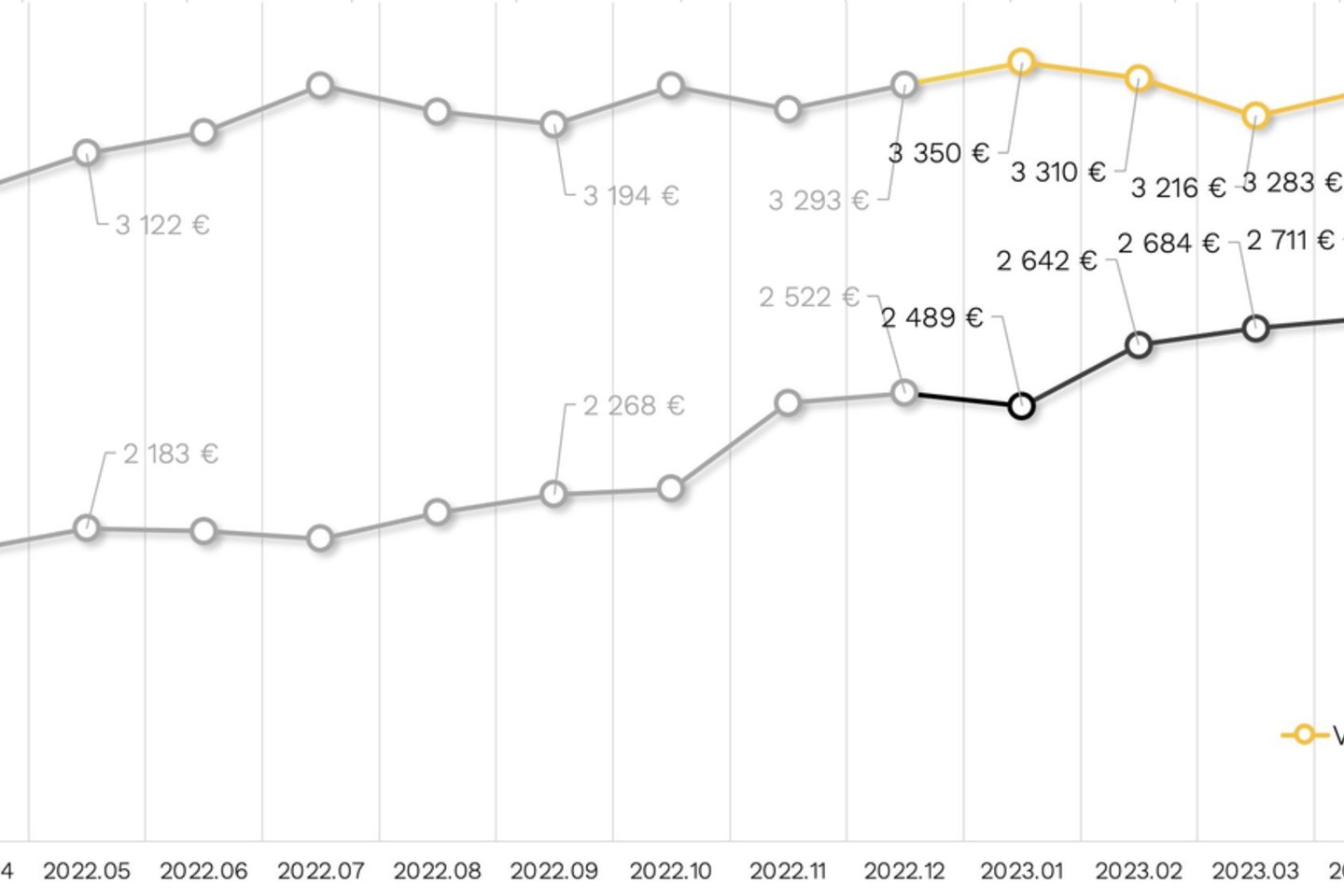

Slow supply growth remains a factor in maintaining price stability. In Vilnius, the average indicative price of new apartments offered in July was EUR 3,295 per square meter, which is EUR 81 higher compared to the previous month. Similarly, in Kaunas, apartment prices changed by EUR 77, increasing from EUR 2,660 to EUR 2,737 per square meter. Since the beginning of the year, the average prices of primary market supply have remained relatively stable in Vilnius, with a slight increase of 0.06%. However, in Kaunas, they have risen by 8.52%.

„Market prices are maintaining stability. While downward corrections often draw attention, they are typically associated with developers' efforts to expedite sales and finalize projects. The recent increase in Euribor has caused concerns about higher monthly mortgage payments, prompting expectations for developer responses. Consequently, sellers, who are unable to reduce prices further, are seeking solutions and offers that reduce short-term financial costs for buyers and aid decision-making,“ notes Tarutis.

The expert emphasizes that such dynamics have persisted historically but have become even more relevant for both buyers and sellers. However, in many cases, these adjustments are marketing tools rather than true price corrections.

In July, Citus concluded 14 transactions across projects in Vilnius, Kaunas, and Druskininkai. The projects Like in New York by CITUS, Visi Savi by CITUS, and PaJustis by CITUS in the capital saw 6 units sold, 2 units were sold in the Radio City project in Kaunas, and 6 units were sold in the Nemunas project in Druskininkai. Overall, Citus-managed projects currently encompass 266 housing units.

Three scenarios for the Vilnius housing market

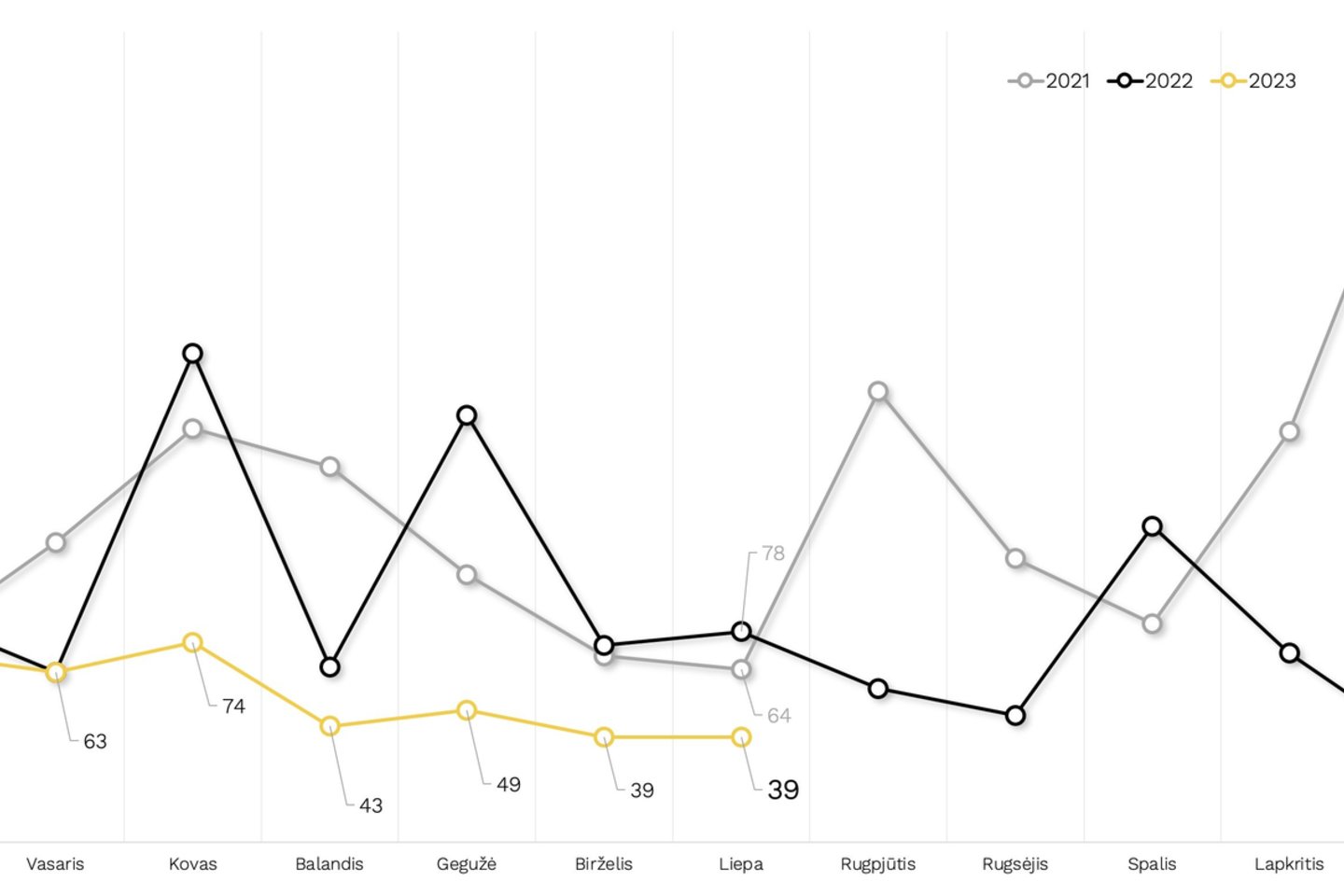

Citus analysts have formulated three potential scenarios for the 18-month trajectory of Vilnius' housing market based on the long-term correlation between annual average Euribor and average transaction volumes in the primary housing market.

Under the forecasts, the 6-month Euribor rate—the commonly used mortgage contract rate—will likely decrease next year, implying heightened activity in the primary housing market as Euribor declines.

Citus analysts have leveraged Euribor forecasts from Chatham Financials and The Economy Forecast Agency (EFA) for their realistic scenario, adapting them to other indicators. These scenarios also consider seasonal trends.

The projected Euribor peak is anticipated at the year's end, followed by a steady decline. The key interest rate is expected to reach 4.1–4.2%, slightly higher than previously assumed. Subsequently, it is anticipated to decrease by around 1 percentage point in the next year, settling at 3.0–3.3%. It's unlikely that the historically low levels of 2015 to May 2022, where Euribor remained in negative territory, will be reached within this decade.

This implies that supply in the Vilnius primary housing market should continue a gradual growth throughout the year, with demand potentially picking up next year. Improved housing credit conditions and affordability may coincide with increased wage growth, creating a favourable environment for house price growth. The demand in the capital's primary market is expected to fluctuate between 350 and 450 new homes per month, with an annual average of 368 homes, a 75% increase over this year's projected average of 210.

Until three months ago, the Euribor peak was forecasted to be lower and to occur earlier, projected for November-December of this year, with a peak 6-month rate of 3.71%.

However, it has already risen to around 3.97% in July and is predicted to continue increasing. Consequently, the peak has shifted two months ahead in the forecasts, accompanied by an upward adjustment in its value.

This variability indicates the existence of multiple scenarios, prompting Citus market analysts to develop a pessimistic scenario. Here, a higher Euribor rate than currently projected is assumed, resulting in slower demand growth. This would lead to a slightly higher-than-forecasted average transaction count of 298 throughout the year.

It's hypothesized that the European Central Bank might raise rates more aggressively this year to tackle inflation. Subsequently, a more cautious approach may be adopted next year, with a slower rate of rate cuts compared to the first scenario. Seasonal trends continue to be considered when estimating potential demand dynamics.

However, the possibility remains that the ECB might opt for earlier and more rapid cuts to the Euribor rate. Current euro area data indicates headline average inflation reaching 5.5%. With economic growth slowing down and persistent global challenges, more positive scenarios might emerge.

Given controlled inflation and upcoming economic challenges requiring preparedness, the ECB may expedite interest rate cuts to stimulate consumption moderately.

In an optimistic scenario, Vilnius' primary housing market could recover by the year's end, approaching 500 transactions per month next year. This optimistic scenario forecasts around 415 new home sales on average next year, nearly doubling this year's projection.

What should people looking for a home expect and look forward to?

It's important to approach these forecasts cautiously, as even the most experienced market research and forecasting entities need to adjust scenarios based on evolving economic developments. However, fundamental assumptions provide a basis to outline possible directions.

„We refer to our analyses as scenarios rather than forecasts intentionally. Forecasts carry a higher level of commitment and influence choices and decisions. While we are confident, based on the available data and insights, that the market will recover and demand will increase over time, we recognize that situations can change rapidly,“ Tarutis remarks. „Three years ago, our pandemic market scenarios were quite accurate, yet even then, growth posed certain challenges despite providing valuable insights.“

According to the expert, the current market remains stable with growing demand. Sellers are striving to present enticing deals due to the expanding supply and heightened competition. Buyers are positioned favourably to select a home today, especially when considering projects still under construction. These projects would likely conclude within 1–2 years, during which Euribor interest rates are expected to be lower, salaries to rise, and monthly financial burdens to be lighter.

Banks are also exploring avenues to enhance housing credit conditions and affordability. Prospective homeowners should seek reduced bank margins for new loans or refinancing existing ones.

Each scenario would influence supply differently. Developers are presently introducing smaller housing „injections“ to the market. If the pessimistic or realistic scenarios materialize, significant shifts in the situation are unlikely. However, an optimistic scenario might hasten the replenishment of housing stock.

In the previous year, the average price growth for new homes on offer was approximately 17%. This year, the monthly change has experienced a growth of around 3% over the past six months. The realistic scenario anticipates 4–6% growth next year. In the event of a pessimistic scenario, prices may remain steady with growth of 2–4%. Conversely, under the optimistic scenario, annual price growth in 2024 might surpass the 10% threshold.