Statistics

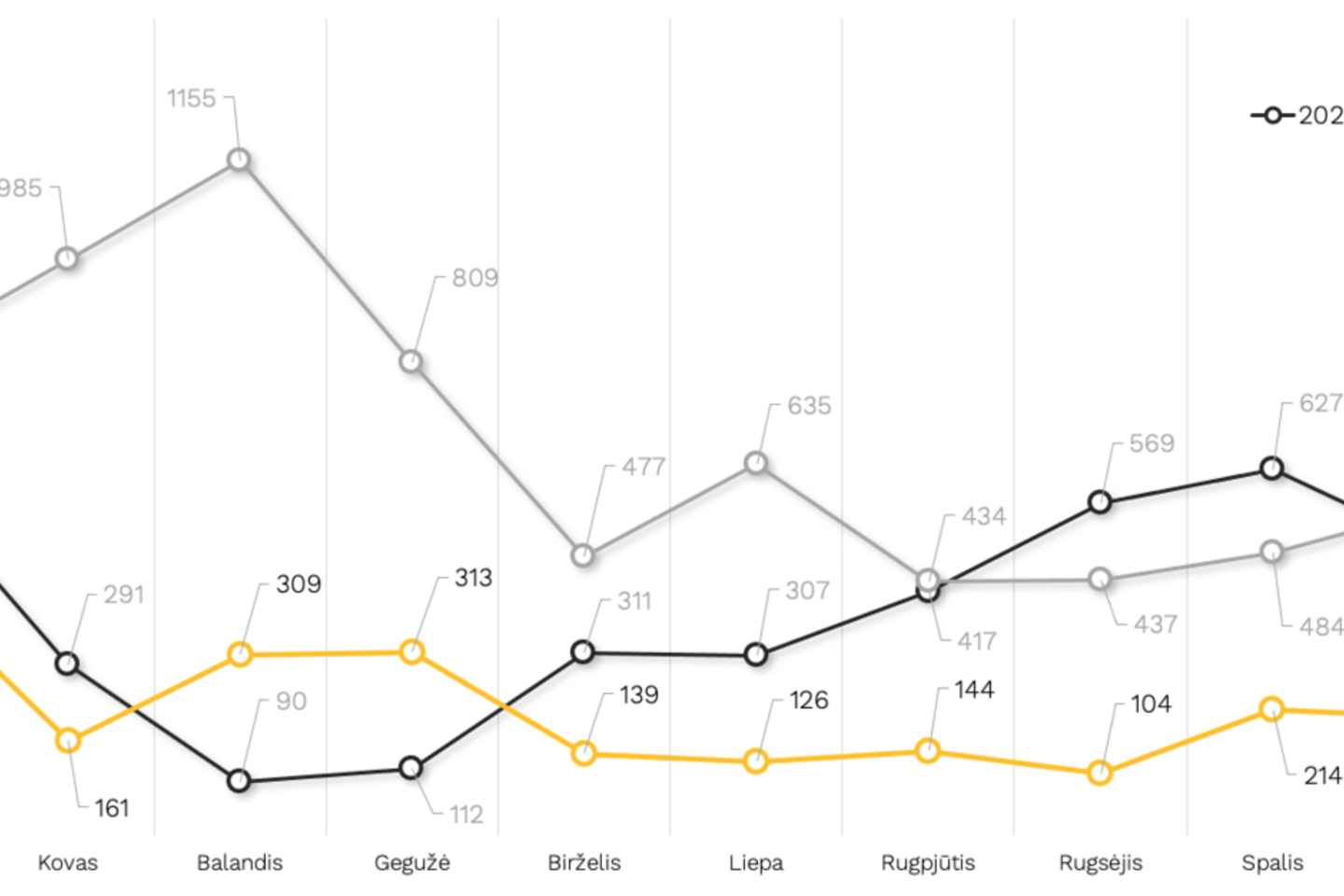

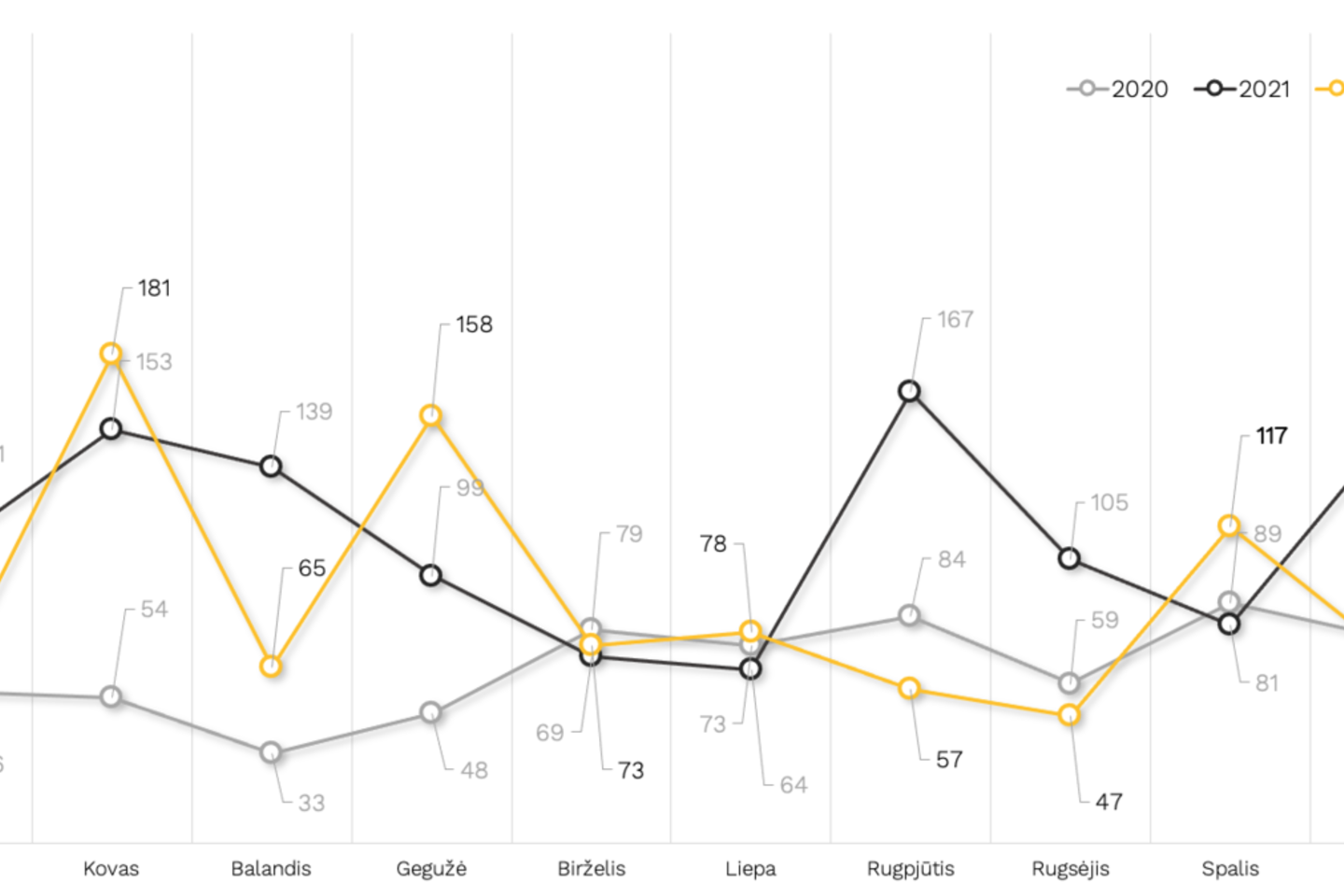

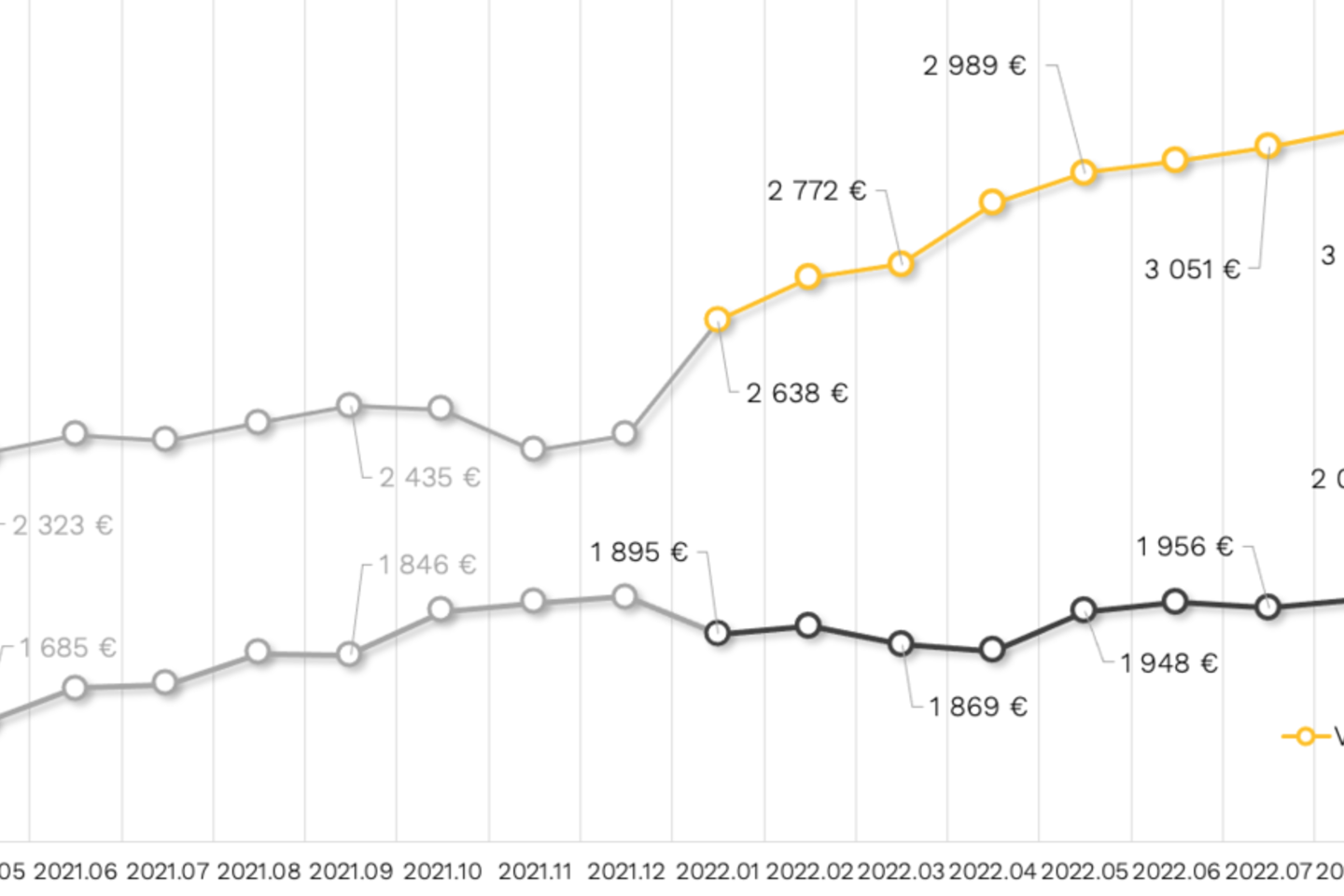

Throughout 2022, according to the latest data from Citus analysts, 2,694 sales of new apartments and terraced houses were registered in the primary housing market in Vilnius. This is almost 3 times less than last year (8,037 homes) and almost two times less than in 2020 (4,949). Over the year, housing supply (stock) in Vilnius increased by 14.4% from 3,551 units (apartments and terraced houses) at the end of 2021 to 4,063 units at the end of December. The year before last, the stock in the capital decreased by 29%, from 5,006 to 3,551. In Vilnius, the average price of the supply of apartments increased by 31% over 12 months, from EUR 2,530/sqm at the end of December 2021 to EUR 3,316/sqm in December 2022. In the previous year, the price change was 23% (from EUR 2,057 to EUR 2,530/sqm). Over the two years, the average price has statistically increased by 61.2%. In 2022, 1,028 sales of new homes (apartments and terraced houses) were recorded in Kaunas, the same number as in Vilnius in Q1 2022. This is 45% less than last year (1,496) but 28% more than in 2020 (806). In Kaunas, the stock of new homes fell from 1,207 to 1,100 over the year (9%). In 2021, the supply in this city grew by 14.5%, from 1,054 to 1,207. In Kaunas, the average price of the supply of apartments increased by about 15% over the year, from EUR 2,164 to EUR 2,489/sqm, reaching the price level in Vilnius at the beginning of 2021. In 2021, the price change in Kaunas was higher by almost 37% (from EUR 1,582 to EUR 2,164/sqm). Over two years, average prices increased by around 57%. The first quarter of this year started with a buying boom in the primary housing market: business is booming with buyers, there is a supply shortage, and bureaucracy is flourishing. But business says: give, and we will make do. Everyone is elated and euphoric. Even customers are a bit „forgotten“ – everyone still buys whatever can they find.

Then the war starts and takes over the second quarter. Companies concentrate on supporting the besieged Ukraine, on internal communication, on dispelling fears among employees and customers, and on trying to predict the future. We have noticed that the real estate sector is the first to feel the economic waves, and the waves here recede the latest. Therefore, on 24 February, the housing market felt it immediately, although, in other areas, it had different effects.

Inflation kicks in during the summer, the liberalisation of the electricity market makes people's heads spin, the European Central Bank starts to raise interest rates, and the Federal Reserve in the US does it even more sharply. As the global economic tectonic plates shake, people start to reassess their biggest purchases, especially if they need a loan. There hasn't been such a tsunami of change for a long time – everything is radically new, but the „party goes on“ – we get used to the changes more quickly and easily, and the burden of inflation is not yet felt, so it's less daunting. However, the party is not going on in the housing sector – the music is quiet, and everyone is calm.

The third quarter was a real breath-holding competition – whether buyers or developers would wait longer. Everybody can wait because both sides have money. The market is strong and solid, and life goes on – as we have been saying during the pandemic – people are born, die, marry, and divorce. So there is a need for housing. As there is a need on both sides we need to find solutions. Businesses are trying to increase supply and are „remembering“ customers and their expectations. As new projects hit the market, demand increases.

However, an important aspect is that the motive for buying a house has changed from „I want“ to „I absolutely need“. When the need to buy for fear of missing out is replaced by the need to buy because there is an objective need, people start to look for the right price and choose very responsibly. So the market has seen a reduction in the speed of sales, but in a very, what I would call, healthy way. There are still customers left who need to buy and who can. The increase in supply allows them to choose a more suitable home, and it is in developers' interest to maintain sales to get better offers.

In the last quarter, with the arrival of utility bills and the recalculation of mortgage payments in line with the rise in interest rates, the consequences are felt by all: costs have risen, but salaries have not risen as much. On the other hand, the housing market is still alive and slightly more active in the last quarter than in the summer.

As I said, the market is sustainable at the moment. Most of the new homes are being sold by the Top 10 developers. These developers have solid financial foundations, choose their own sales speed and can therefore dictate prices. On the other hand, they are interested in keeping the sales going, as the expectations of the whole market – both buyers and sellers – depend on it, so there is less room for prices to rise. Smaller players with interest in turnover also make various offers to buyers. After a long period of sharp increases, prices have stabilised and can now be described as fair – in line with the value of the property and market realities. The year was also marked by a record number of home loans granted by banks.

We will see this trend, the stabilisation of prices and not particularly high sales numbers in the next quarter. Such figures do not reflect the potential of the Vilnius or Kaunas markets, but they do reflect the situation and ensure viability. In the short term, average prices for new housing will grow by up to 3% or remain stable across the market.

Well, the most memorable thing for me this year was the mobilisation of people in support of Ukraine. There was a general awareness that there are forces and interests that seek to divide society, but we have learnt to recognise them and fight them. Once again, since the quarantine, there has been a fantastic mobilisation of society, a mobilisation of a passion for defeating evil and hostile forces. We could not fail to join in, both as a company and most of us individually. This togetherness will help us withstand any adversity, economic volatility or uncertainty.

Statistics

In the first quarter, 1,027 homes were sold in Vilnius and 328 in Kaunas. Prices in Vilnius increased by 7.5%, while in Kaunas, they shrank by 2.8%. In the second quarter, 761 homes were sold in Vilnius and 296 in Kaunas. The warehouse stock in Vilnius grew by only 1%, and in Kaunas – by 20.5%. Prices in Vilnius increased by 13.9% and in Kaunas – by 0.1%. In the third quarter, 374 homes were sold in Vilnius and 182 in Kaunas. The stock in Vilnius grew by 12.6%, and in Kaunas, it shrank by 1%. Prices in Vilnius increased by 5.4% and in Kaunas by 4.2%. In December, 117 sales were recorded in Vilnius and 35 in Kaunas. In Vilnius, the warehouse stock grew by 3%, supplemented by four new projects and one phase of an earlier project, totalling 212 apartments and 26 cottages; in Kaunas, the warehouse stock remained virtually unchanged (contracted by 0.6%), while two small new projects with 26 apartments were offered to buyers. During the whole of Q4, 532 homes were sold in Vilnius and 222 in Kaunas. The warehouse stock in Vilnius grew by 7%, while in Kaunas, it decreased by almost 13%. Prices in Vilnius grew by around 9%, while in Kaunas, by 7.3%. The Citus year

The 10th anniversary year was a difficult one for our company. Full of pleasant and not-so-pleasant surprises and various challenges, but successful.

Probably the biggest work of the year was the finalisation of last year's and even earlier sales: during the year, we signed almost half a thousand notarial contracts for EUR 56 million, which is the best result in Citus history. We had to work extremely hard, and we did not avoid some failures and mistakes, but we are learning and correcting them.

We sold 272 units in our managed projects during the year: 139 in Vilnius, 64 in Kaunas and 69 in Druskininkai. In this resort, the Citus-managed conversion project Nemunas by CITUS has become a sales champion, with construction work in full swing.

In all three cities, work was actively underway. In the capital, we have received permits, and construction has started on the third and final phase of Miško Ardai by CITUS and Visi Savi by CITUS; in Kaunas, work is underway on the new phase of Radio City by CITUS; and most pleasingly, work on Nemunas by CITUS in Druskininkai is moving ahead quickly after the building permit.

We have already registered 80% completion in some projects and handed over homes to new owners. We have done this in the second phase of the Miško Ardai by CITUS project, in the first two phases of PaJustis by CITUS, in Link Ten by CITUS, and in Kaunas in Klevų namai by CITUS and part of Radio City by CITUS.

We have completed some older debts: completion has been registered for the eighth and ninth phases of the Karaliaučiaus slėnis (Karaliaučiaus Valley) project, and we have finally received the building permit for the reconstruction of the Pilaitė intersection, which has been several years in the making, and we will aim to complete the construction and register completion together with the tenth phase of the Karaliaučiaus slėnis quite soon.

We are intensively preparing for the three projects that we will launch this year: the Mūnai by CITUS and Like New York by CITUS projects will be offered in the North Town, and Tyzenhauz by CITUS will be offered near the Dawn Gate. Like New York by CITUS, part of the project, has already been granted a building permit, work is underway on the site, and the other two are in the design and publicity phases.

Predictions for 2023

Longer-term forecasts are too difficult to make at this stage – it would be like making a fortune from coffee grounds. However, we should not forget the still disrupted supply of materials and price changes. There are some good signs, however, as some prices have stabilised and others have even started to fall. Unfortunately, due to the change in the supply situation, the reduced choice, and the dependence of material prices on energy resources and wages, the prices of some basic works and materials do not foretell a rapid or significant decrease in 2023 (ECB forecasts – https://www.ecb.europa.eu/pub/projections/html/ecb.projections202212_eurosystemstaff~6c1855c75b.lt.html). And as central banks stop raising interest rates and start stimulating economies, materials may start to become expensive again. In response, we are breaking down projects into phases (both development and sales) to control the situation and ensure that we meet our customers' expectations.

The biggest question at the moment is hanging over international interest rates. They do not have an obvious direct impact on the cost and final price of housing, but they have a critical impact on housing affordability. If central banks see that prices are not falling, interest rates will continue to rise. We can already see that they could reach 5%, whereas until recently we expected them to stop at 3 or 4. If they reach that level, businesses will face survival challenges: some will not be able to contain costs, and the banks will squeeze others for credit. In this case, there will be a market cleansing, with the most resilient and fastest adapting businesses surviving. And it is too early to expect interest rates to stop rising, even though economists say that the peak in inflation is already past.

Interestingly, in the media, traders and analysts are celebrating the US holiday sales, which, despite high inflation and low merchant expectations, exceeded last year's upbeat results by 2.3% and were the most successful in history. What does this mean for the Federal Reserve? Unsustainable demand continues to heat up prices and push up inflation. The likely result is higher interest rates. Other central banks would follow suit because the economy is global, especially as wholesale prices on world markets and consumer price indices continue to rise, although not as fast as before.

And there will be a number of factors affecting both the global and the Lithuanian economy and hence the real estate sector and the housing market. We will only find out how the situation in the energy sector will evolve next quarter. Geopolitical turmoil will also only be known next quarter. The direction of inflation, central banks' plans and consumer expectations will also be revealed next quarter. It is only possible to forecast trends for next year today on the assumption that „the variables will remain constant“. We said the same thing at the beginning of the pandemic, but this time many more factors can change quickly and have a huge impact, even though the uncertainty seemed to be at its maximum even then.

The fact is that the winter season, the energy demand, and with it the issues of rising prices, and the sufficiency and substitutability of energy resources, will be resolved in the next few months. It is now becoming clear that the coldest months are survivable, gas storage in Europe is filling up, and there is even surplus electricity production, which means that energy resources are becoming cheaper, so that, for the time being, the major European economies can breathe a little easier, and that is what consumers' expectations, etc., depend on.

All of this will have a major impact on the housing market in Lithuania. In the largest markets, Vilnius and Kaunas, as in other cities, there will be municipal elections, which will determine whether the cities will move towards solutions, transparency, efficiency, and dialogue or whether they will turn back to the year 2000. Today, Vilnius – although I am sure there are those who disagree – has, in principle, chosen a vector of change and a future perspective and is becoming a modern, good-for-walking city whose development has rules and norms. The next quarter will also show how things will continue and what the temporary capital will choose.

In Vilnius, housing market activity may remain at around 200–300 transactions per month throughout the year. Again, if the factors at work today remain unchanged. However, things are likely to change, and not for the better. First of all, I am talking about interest rates. Their rise will continue to chill the market. The trend in material prices suggests that we can expect a reduction in the cost price, which will make it easier for the market to find the right price that satisfies all parties. It will continue to make no sense to build „in the warehouse“ due to the lower market activity, and projects will be built and sold in smaller phases.

We expect to see a change, a recovery and an intensification of the market in the spring and summer of this year. But that is already 2–3 quarters and it is difficult to forecast that far ahead based on the current dynamics. This may be a good thing: to adapt to and survive such a sprint requires a high degree of focus, managerial maturity, competence and great creativity, but in such circumstances, solutions and formulas for success are discovered more quickly, and the likelihood of prolonged stagnation is therefore reduced.

I hope that there will not be a sudden change in the market itself, where the pent-up demand for housing will turn into a compressed spring, and the situation will become similar to the second half of 2020. Housing is a purchase that has to be decided based on necessity, not based on fashion or fear of missing out when everyone is rushing to buy. The market has clearly shown that sudden price changes and house sales do not happen without the necessary preconditions. Developers are in a financially stable situation and are not only in a hurry to sell but also to buy: plots, projects, plans and visions for the future. If the current activity is maintained and rises consistently, supply and demand will not be out of balance, and prices and affordability will remain stable. Meanwhile, if the market is affected by ill-informed decisions (e.g. someone suddenly starts to let prices go and the range is reduced, and there is no replenishment available, so prices start to rise again), everybody loses out, and a good moment of the combination of sufficient supply and fair prices is lost.