Take Vilnius and Kaunas. A similar calculation can be done in Klaipėda or any other city, for certain factors apply everywhere; but Citus experts will help you assess alternative assumptions.

Example 1 – mid-range apartment in Vilnius

One example of a promising location: in the rapidly resurgent Žirmūnai, next to the „North Town“, a 2-room apartment of about 45 m2 with partial finishing or a 1.5 size room, including a fully furnished apartment with an area of about 35 m2, with a single parking space, will cost you about 150,000 Euros.

Buying an apartment with a bank loan will require 15% or 22,500 EUR, while the loan amount will be 127,500 EUR. The 6-month Euribor interest rate, which is very important for assessing the monthly payment, is currently 4.11%, and the bank's margin is around 2%; making the total 6.11%. If such a loan is taken out for 30 years, the monthly installment will be around €770.

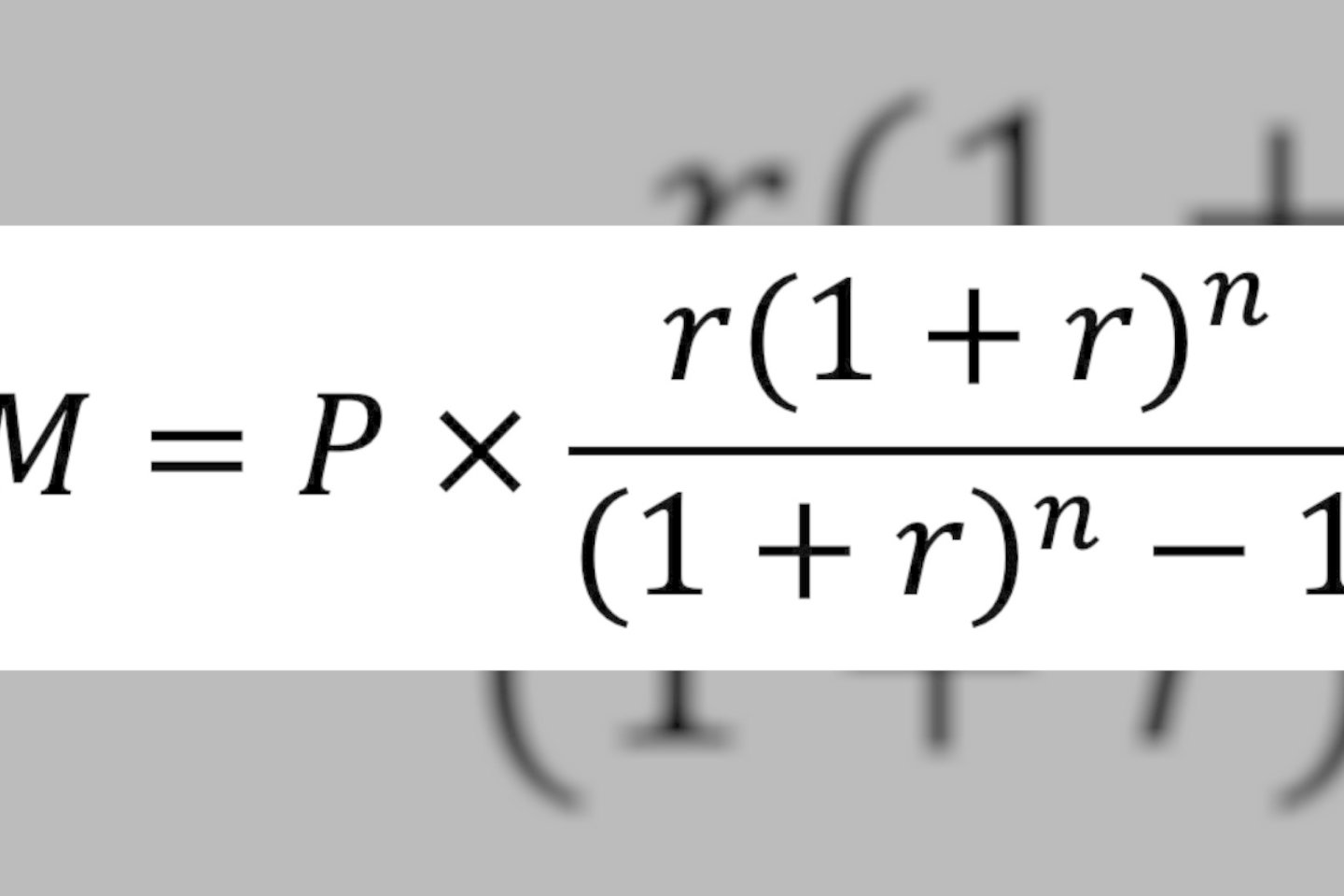

In calculation of the installment amount, we use the annuity formula, by which, with changing of the parameters, it is possible to calculate a number of different options. In the Excel program, the installment can be calculated using the „PMT“ function, and represented as:

In this case:

– Where M is the monthly instalment,

– P is the loan amount (127,500 EUR),

– r is the monthly interest rate (i.e., an annual interest rate of 2+4.11% divided by 12 months gives 0.50925% or 0.0050925),

– n is the total number of payments over the lifespan of the loan (30 years x 12 months i.e., 360 months).

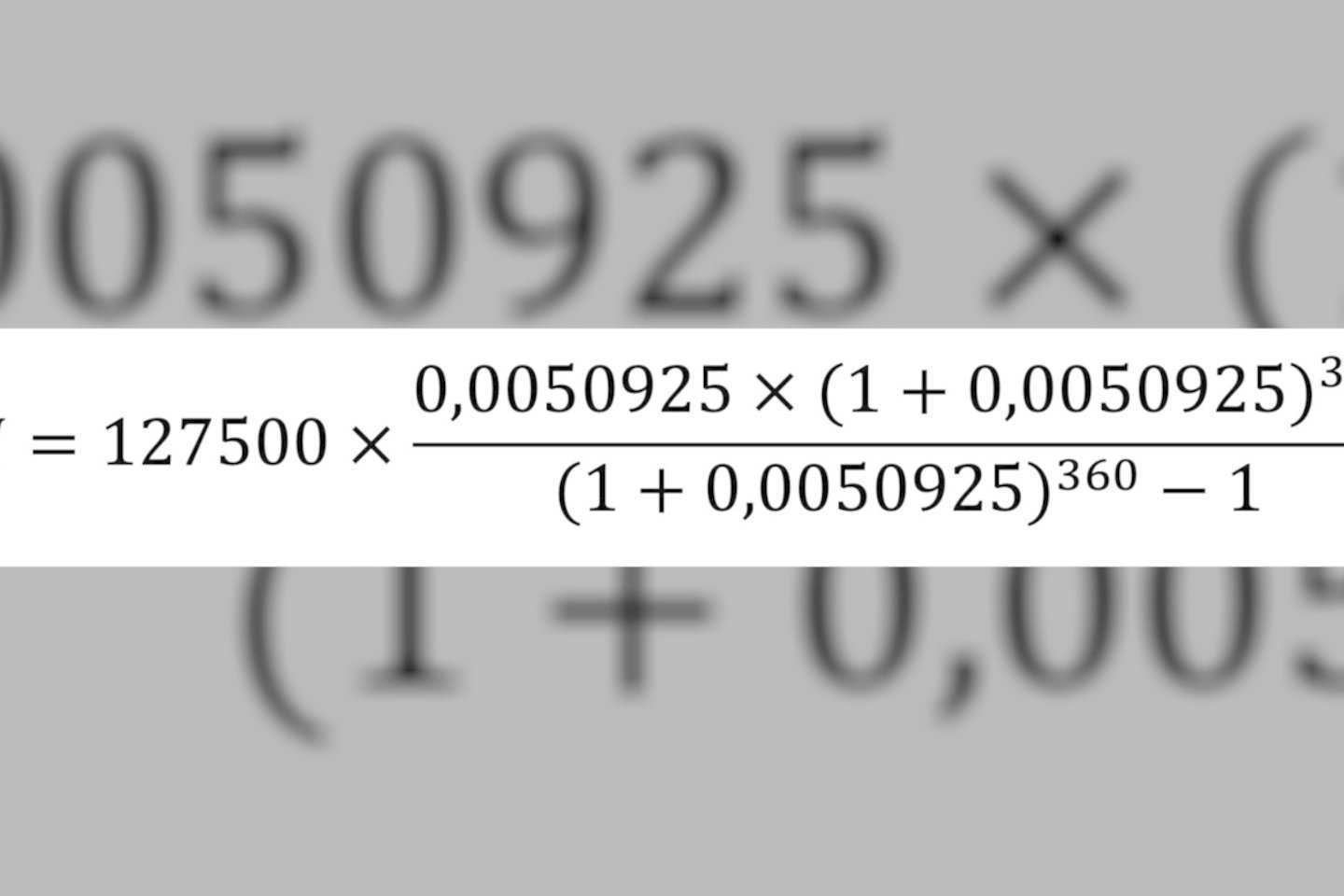

We plug this data into the following formula:

These calculations bring about a monthly payment of around €770.93. It is true that, as the outstanding amount of the loan and the Euribor decrease, the installment would also decrease. According to existing projections, after two years, it would amount to around €645/month.

The monthly payment may vary slightly depending on the bank from which you take out such a loan, plus fees, insurance and other factors. Other repayment schemes are also available.

Citus experts predict that house prices will grow moderately over the next two years, at around 4% annually. This means that the price of a given apartment would rise to 162,240 EUR, while a loan of 85% of the price would amount to 137,904 EUR.

To add the figures to the formula, the monthly payment amounts to around €750. So, this means: just €20 less than today, but €80 more than the mortgage payment in two years.

Within two years, you would have paid off part of the mortgage you are currently buying, and the balance would be around €119,000 – you would have already invested more than €8,500 in your home. And, if you had to rent during such a period, renting would cost €15,600 for the same period or €650 a month for a similar apartment.

„So, according to the maths, waiting two years would result in an expected loan payment very similar to one which would be expected with buying now, for major price changes are not foreseeable. However, the falling Euribor will also reduce mortgage payments on a home bought today, paying off part of the loan, increasing the value of the home and avoiding the need to pay rent, this being similar to monthly mortgage payments,“ said Šarūnas Tarutis, Head of Investment and Analysis at Citus.

If the situation remains as it is today

If the declining Euribor does not bring about shifts in the housing market and the dynamics of supply and demand remain as they are today, the cost of housing in Vilnius will rise by around 1% based on this year's price developments.

In such a case, if one were buying a home in 2 years, the price could be around €153,000, the loan amount around €130,000, with the monthly payment including a 3.1% Euribor rate of about €700.

Even if the prices do not increase, the monthly installment rate will be higher (around 690 Euros) compared to the installment of an apartment acquired today in 2 years.

Will they benefit from a price decrease?

Even a scenario like this is not worth waiting two years for. Suppose the current situation were to persist, with prices falling by 3% next year and by as much as 5% the year after. The loan would amount to €117,491.25, and the monthly payment would be around €640. This would differ significantly from the loan amount of today (about €770).

However, in those two years, as mentioned above, the mortgage on the house purchased today would already have been reduced, meaning that the remaining monthly payment would be almost the same (€645), and the money would have already been spent on the home itself, and not on renting it. All the more so because, in the long term, the value of homes will still increase, so such an investment will improve.

Kaunas: the situation is even more perilous

House prices in Kaunas are slightly lower than in Vilnius. For 150,000 EUR, an apartment with an area of about 54 m2 can be bought in the temporary capital, while an apartment with an area of 45 m2, as exemplified in Vilnius, can be purchased for about 125,000 EUR. Such an amount would be sufficient for a quality, mid-range apartment in Aleksotas or the popular area of Šančiai. There is plenty of choice.

A bank loan for a house would amount to €106,250, and the monthly repayment, at the current Euribor interest rate of 4.1%, would be around €640.

However, housing is becoming more expensive much more quickly in this city. If the trend continues over the next two years, the cost of housing here will rise by around 7–8% per year. In such a scenario, the same house in Kaunas could cost 144,450 EUR at the end of 2025, with a borrowing cost of 122,782.50 EUR; and, with the Euribor rate falling to 3.1%, as currently forecast, the monthly payment would be around EUR 670.

Meanwhile, in those 24 months, the amount of the mortgage loan on the home now purchased would have fallen to just over €99,000, and €7,000 would have been invested in equity, while the contraction of the Euribor would have reduced the monthly installment to around €535. Renting a similar property for those two years at €550 per month would require another €13,200.

„The other scenarios in Kaunas are just like those in the capital, but the prices differ. However, it seems that the more turbulent market in the second-largest city is not willing to make concessions, and, due to low supply, prices tend to rise. Klaipėda and other cities can also be assessed according to this principle, but one should take into account the trends in price dynamics in those cities,“ emphasises Š. Tarutis.

Verdict: it's risky to delay, and potential savings are only symbolic

According to experts, there are currently a number of aspects which qualify as the most important ones. Firstly, even if prices adjust downwards, it makes more sense to decide to buy a home sooner: the mortgage balance decreases over time, which reduces the down payment, and there is no need to think about renting a home; better invest in your own property.

Secondly, Šarūnas Tarutis believes that, by simply delaying one’s decision and not considering the need for housing, the demand only accumulates as the population of cities grows. If the housing markets were to become more active, the stock would melt away very quickly and would not be able to replenish itself; something that would severely restrict choice and worsen purchasing conditions. A difference of a few or a dozen Euros a month is not worth the risk.

„There's another point. Today, with a significant drop in demand in the major cities, the stock of fully completed housing is slowly filling up. Such homes can be purchased and notarised immediately, meaning that the interest rates payable would be those in force today, based on the Euribor rate. Not everyone can buy a home with the funds that they have without bank financing – the interest rate is a major factor. Today, if you reserve a home under construction, the price would be fixed in the preliminary deal, and when the construction is finished, and it is time to close the deal and take out the loan, the Euribor should have already fallen,“ advises Š. Tarutis.